|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

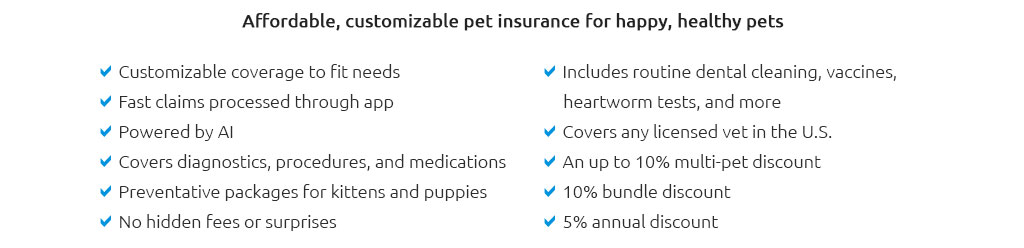

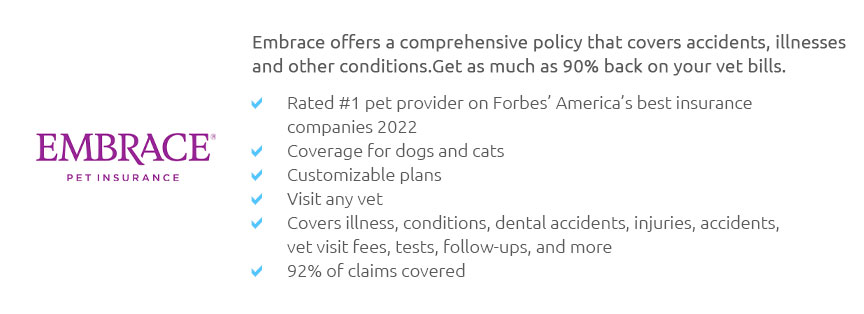

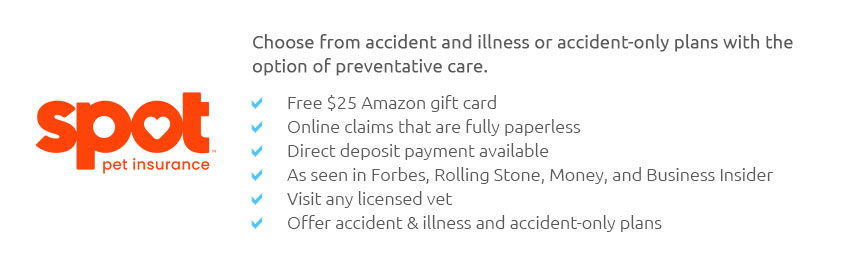

Understanding How to Compare Pet Insurance Quotes: A Comprehensive GuideIn today's world, where our pets are not just animals but cherished family members, safeguarding their health becomes a priority. As veterinary costs rise, pet insurance emerges as a vital tool for pet owners. However, choosing the right policy can be daunting. Comparing pet insurance quotes is essential to ensure you get the best coverage for your furry friends. This guide aims to elucidate the steps involved in this process, while subtly hinting at the nuances that make it an art rather than a mere task. Firstly, it is crucial to understand the types of coverage available. Most policies fall into categories such as accident-only, time-limited, maximum benefit, or lifetime cover. Each has its merits and limitations, dictating the scope and duration of the protection offered. For instance, while accident-only policies are economical, they might not cover illnesses that can often be more costly. On the other hand, lifetime cover offers comprehensive protection but at a premium cost. Therefore, assessing the specific needs of your pet, considering their age, breed, and medical history, becomes a fundamental step in the comparison process. Another critical aspect is to analyze the cost versus benefit ratio. While it might be tempting to opt for the cheapest option, it is essential to examine what each policy covers. Deductibles, co-pays, and annual limits are terms that should be part of your vocabulary when scrutinizing the quotes. A policy with a low premium might come with high deductibles, meaning you'll pay more out-of-pocket during a claim. Thus, balancing the monthly premium against potential future costs is wise. Many pet owners find that paying a little more each month can save significant amounts in the long run, especially if unexpected illnesses or accidents occur. Furthermore, the reputation of the insurer should not be overlooked. An insurance provider's track record in handling claims is as important as the policy itself. Reading reviews and seeking recommendations from other pet owners can provide insights into an insurer's reliability and customer service quality. Also, consider the speed and ease of the claims process. Some companies offer direct payments to veterinarians, reducing the financial burden on you during emergencies. Moreover, do not underestimate the value of discounts and incentives. Many insurers offer discounts for insuring multiple pets or for microchipped animals. Additionally, some policies include wellness plans that cover routine check-ups and vaccinations, promoting preventative care. These can be particularly beneficial, ensuring your pet remains healthy while reducing overall healthcare costs. Lastly, the fine print can hold the key to a policy's true value. Exclusions, waiting periods, and conditions for renewal are details that require careful reading. It's vital to ask questions and seek clarification on anything you do not understand. Pet insurance is a long-term commitment, and understanding every aspect of your policy helps avoid unexpected surprises. In conclusion, while the task of comparing pet insurance quotes might seem tedious, it is a crucial endeavor that can safeguard your pet's health and your finances. By taking a comprehensive approach-assessing coverage types, weighing costs against benefits, evaluating insurers, and paying attention to details-you can find a policy that offers peace of mind. After all, your pet deserves nothing but the best care, and with the right insurance, you can ensure they receive it without compromise. https://www.nerdwallet.com/p/best/insurance/pet-insurance-companies

Compare quotes. The cost of insurance for dogs and cats varies by carrier and the amount of coverage. Some pet insurers offer discounts; you ... https://www.progressive.com/pet-insurance/

Get a pet insurance quote so your furry friend can thrive. Get a quoteOr ... https://www.petinsurancequotes.com/compare/

You can compare the top pet insurers side-by-side by clicking on the links below. Each chart shows coverage options, customer ratings, and additional ...

|